Trade alongside sophisticated institutions, family offices and algorithmic traders on Clear Street's new trading platform.

Learn moreClear Street — Modernizing the brokerage ecosystem

A Clearer Path to Liquidity

In today’s fragmented markets, participants need seamless access to liquidity across trading venues, supported by both sophisticated technology and personalized service. Many firms remain constrained by legacy systems or limited connectivity, leading to missed opportunities. We overcome these barriers via a full suite of execution services, uniting high-tech tools with an expert trading desk.

~$28.4bn

notional / day

~2.4mn

average daily transactions

94% YoY

transacted growth

~4%

U.S. equities market share

~700

institutional clients

The Clear Street Difference

01234

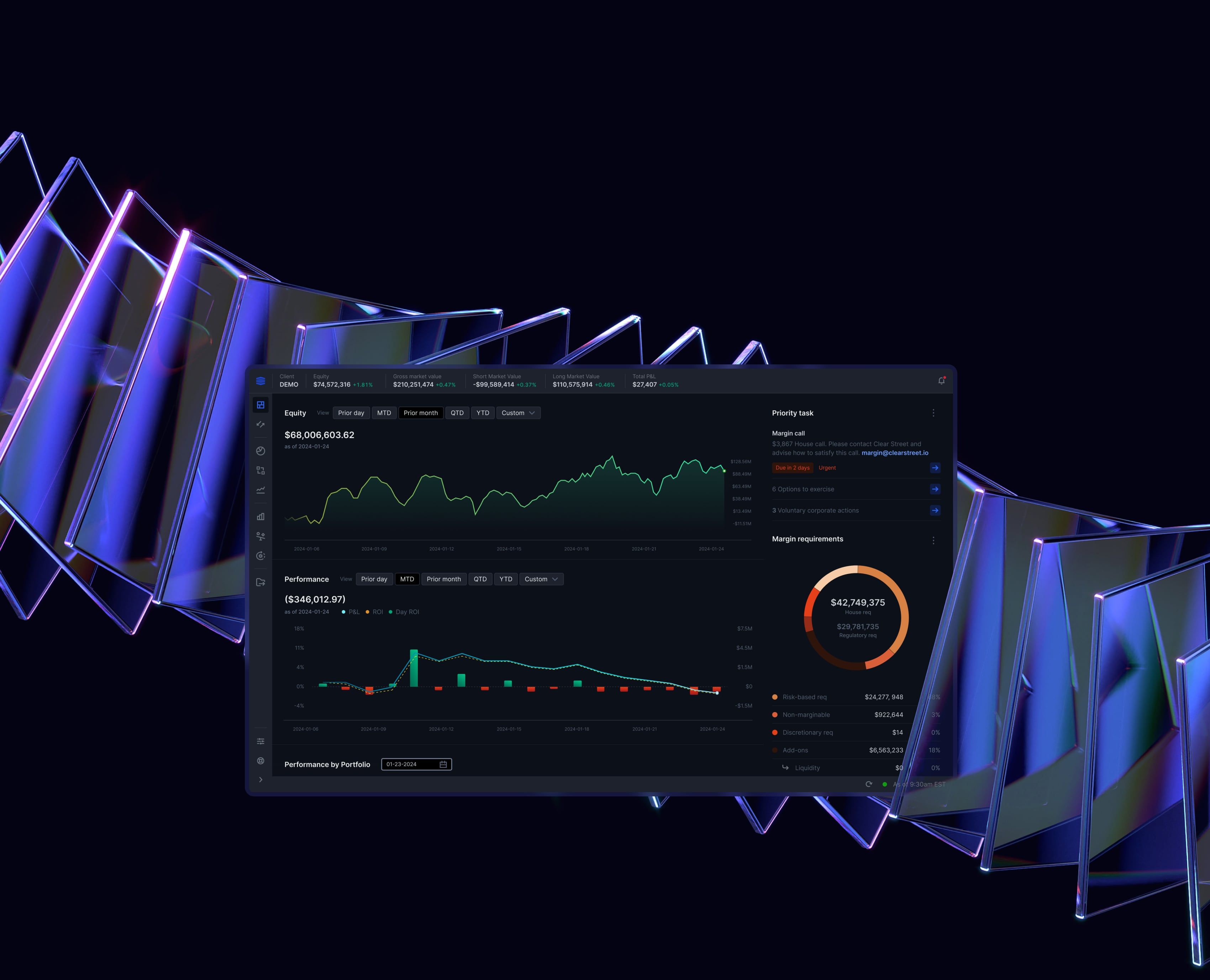

Cloud-Native Platform

Fully integrated execution and risk system built in the cloud for real-time visibility.

24x6 Coverage

Fully staffed trading desk and 24x6 electronic execution provide continuous market access, no matter the time or asset class.

Advanced Algorithms

Proprietary Clear Street Algos and smart order routing scan 50+ lit/dark venues to optimize price and liquidity.

Tailored Execution

Choose among high-touch, low-touch or hybrid models, supported by deeply experienced traders, hyper-modern tools and our flexible outsourced trading solutions.

- 0 1

Cloud-Native Platform

Fully integrated execution and risk system built in the cloud for real-time visibility.

- 0 2

24x6 Coverage

Fully staffed trading desk and 24x6 electronic execution provide continuous market access, no matter the time or asset class.

- 0 3

Advanced Algorithms

Proprietary Clear Street Algos and smart order routing scan 50+ lit/dark venues to optimize price and liquidity.

- 0 4

Tailored Execution

Choose among high-touch, low-touch or hybrid models, supported by deeply experienced traders, hyper-modern tools and our flexible outsourced trading solutions.

Execution & Trading Services

Experience execution without friction. Extensive venue access, configurable workflows and robust coverage.

Derivatives

High-Touch Trading

Low-Touch Trading

Clear Street Algos

Outsourced Trading

Trade with full context

Trade in One Place

Order ticket with in-ticket locates, L1/L2, time & sales and a live order blotter.

Act with context

Real-time positions, P&L and intraday margin by position – plus baskets/rebalances and direct actions from the positions table.

Plug in and scale

FIX/API with your OMS/EMS, and REST/WebSocket to automate – on the same rails used by financing, clearing and ops so data stays consistent.

Common questions

Simple answers

How do I open an account with Clear Street?

Prospective clients can get in touch with our sales and onboarding team via our Contact page. A representative will reach out to discuss your execution needs.

What makes Clear Street different?

Clear Street’s mission is to give every sophisticated investor access to every asset, in every market, through a unified platform built for speed, transparency and scale.

We give our clients the technology, tools and service once reserved for the largest institutions, rebuilt with modern infrastructure. Our single, cloud-native, end-to-end capital markets platform powers investor growth today and is transforming how they can interact with markets tomorrow.

What types of asset classes can I execute through Clear Street?

Clear Street supports trading across U.S. equities, options, futures and fixed income, including repos. We further support swaps, foreign exchange, UK and Canadian equities and options, metals and other commodities and (coming soon) digital assets.

When should I choose high-touch versus low-touch trading?

High-touch execution is best for complex block trades, special situations or when you need experienced traders to source liquidity and provide market color – especially during periods of volatility or in pre- and post-market sessions when liquidity and pricing can become dislocated. Even clients who rarely trade pre- or post-market often find they need access in fast-moving conditions, and having a seasoned desk that knows how to navigate those moments can be critical.

Low-touch execution offers scale and consistency throughout the trading day, with smart order routing and direct access to 50+ venues for electronic fills. There is no one-size-fits all solution and many clients use a hybrid approach, relying on low-touch execution for routine trades and turning to high-touch expertise when markets move fast or liquidity is harder to find.

How do Clear Street algorithms differ from standard broker algos?

Clear Street's proprietary algo suite is designed to “think like a trader,” using predictive volume and alpha signals to outperform traditional benchmarks like VWAP/TWAP. Specialized strategies – such as Fox Alpha for participation, Fox Blaster for aggressive arrival and Fox Dark Attack for hidden liquidity – give clients more nuanced control over execution outcomes.

What level of control do clients have over their electronic orders?

Clients can customize order display size, minimum fill, fee sensitivity, sweep style and venue exclusions. The system supports single- and multi-ticket workflows and integrates with FIX/API and leading OEMS platforms for seamless alignment with client operations

Can Clear Street’s outsourced trading desk supplement my in-house team?

Yes. Clear Street offers flexible models ranging from supplemental capacity to fully outsourced desks. Clients gain access to experienced buy-side traders, widespread broker connectivity and Clear Street’s technology infrastructure while optimizing their resources and operational overhead.