Smarter Capital, Elevated Results

In today’s capital markets, emerging companies face significant challenges: slow deal cycles, siloed processes and limited investor reach. Clear Street’s solutions combine strategic advisory with cutting-edge infrastructure. Our investment banking team delivers real-time transparency, creative financing structures and precise execution across equity, debt and M&A, with deep sector expertise and proven frameworks so clients can move faster and raise capital with confidence.

75+

transactions YTD

~$85bn

value of transactions YTD

>$95bn

value of transactions since launch

34

Investment Banking professionals

The Clear Street Difference

Integrated Banking + Trading

Access key investment banking and execution services on a single real-time ledger; precise coordination across equity, debt and M&A.

Sector Expertise

Dedicated coverage across Blockchain & Digital Assets, Artificial Intelligence, Disruptive Tech, Biotech & Healthcare and Specialty Finance ensures tailored insight and investor alignment.

Investor Connectivity

Corporate access and equity research expand and target institutional distribution.

Treasury Financing & Collateral

Repo, stock loan and real-time collateral optimization to lower funding costs and streamline post-deal operations.

- 0 1

Integrated Banking + Trading

Access key investment banking and execution services on a single real-time ledger; precise coordination across equity, debt and M&A.

- 0 2

Sector Expertise

Dedicated coverage across Blockchain & Digital Assets, Artificial Intelligence, Disruptive Tech, Biotech & Healthcare and Specialty Finance ensures tailored insight and investor alignment.

- 0 3

Investor Connectivity

Corporate access and equity research expand and target institutional distribution.

- 0 4

Treasury Financing & Collateral

Repo, stock loan and real-time collateral optimization to lower funding costs and streamline post-deal operations.

Industries We Serve

Blockchain & Digital Assets

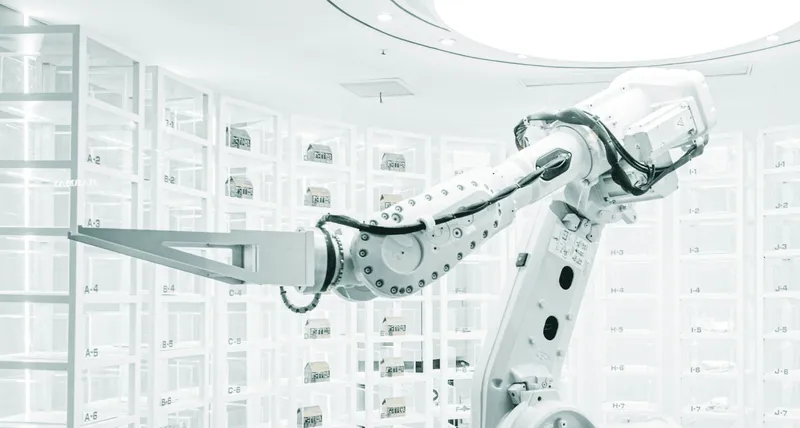

Artificial Intelligence

Disruptive Technology

Biotech & Healthcare

Specialty Finance

Key Services for Corporate Issuers

A single point of access with everything you need to raise capital, execute sensitively and operate efficiently.

Capital Markets

Transaction Advisory

Equity Research

Corporate Access

Select Clear Street Investment Banking Transactions

Common questions

Simple answers

How do I engage Clear Street for a transaction?

Prospective clients can get in touch with our sales and onboarding team via our Contact page. A representative will reach out to discuss your needs as a corporate issuer.

What makes Clear Street different?

Clear Street’s mission is to give every sophisticated investor access to every asset, in every market, through a unified platform built for speed, transparency and scale.

We give our clients the technology, tools, and service once reserved for the largest institutions, rebuilt with modern infrastructure. Our single, cloud-native, end-to-end capital markets platform powers investor growth today and is transforming how they can interact with markets tomorrow.

Can you help manage investor outreach around a deal?

Yes. We combine corporate access with equity research to target the right investors and maintain engagement pre- and post-transaction.

Do you support issuer treasury operations outside of transactions?

Yes. Issuer accounts can leverage repo, stock loan and collateral optimization tools for ongoing funding and risk management.

Do you support structured employee liquidity or sponsor sell-downs?

Yes. We execute targeted placements and structured secondaries with controlled distribution and tight settlement timelines.