Increasing Transparency in Securities Finance

On the latest episode of our podcast Word on the (Clear Street), Chief Information Officer Jon Daplyn and I discussed opportunities for technological innovation in the securities lending market.

This episode comes at a pivotal time for securities lending. Last month, the SEC approved the new Rule 10c-1a, which will require certain entities to report information about securities loans to a registered national securities association (RNSA) and require RNSAs to make publicly available certain information that they receive regarding these lending transactions (i).

The resulting data, when anonymized and made public, will shed light on the securities lending supply chain for the first time in its history. As a technology-first Prime Broker, Clear Street is well positioned to capitalize on this data to offer meaningful, actionable insights to our customers.

Data-backed decisions

Let’s take a step back to examine the motivations behind this new rule. The quest for transparency in the securities market is nothing new - tracing back to the implementation of the Dodd-Frank Act in 2011 - it has taken the SEC more than a decade to define the mandates in the 10c-1 legislation (ii).

By mandating more transparent and efficient reporting, regulators hope to better understand systemic risk, and be prepared to make decisions during future market events. Around the world, regulators are tightening their rules and guidelines to have better oversight on the market, particularly in traditionally opaque businesses like securities lending.

There are several differences between proposed and final rule - including reporting timeframes, covered persons, and reportable securities and loans - but the goals of the proposal and rule remain the same:

- Market transparency

- Improved Price discovery

- Systemic risk and supply chain visibility

Reporting Requirements

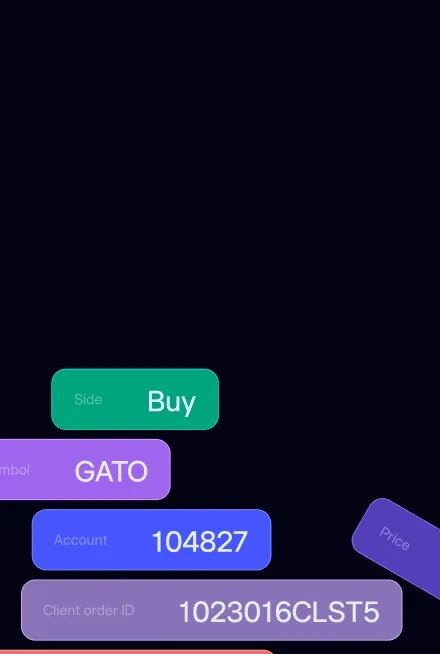

Under the new 10c-1, when a loan is effected or modified, the following must be reported by the end of the day:

- Security information (issuer, asset identifier)

- Time and date of the loan

- Name of platform/venue

- Amount* (not made public immediately)

- Rates, fees, charges or rebates

- Type of collateral provided

- Margin (over-collateralization factor)

- Termination date

- Type of borrower

This transactional-level data will need to be made publicly available by the next business day morning, except for “amount,” which will be public 20 business days later. Aggregate data (including distribution of loan rates) will also be reported the next business day. Some loan terms will not be public, including legal names, broker-dealer lender information, and whether the loan closed out a fail-to-deliver.

Widespread impact

The availability of this stock loan activity data is likely to become an important source of signal for the cash equities and options market. However, there is a risk that untrained eyes could misinterpret the data - for example, the nuances of counterparty trust, stability of supply and collateral quality play an important role in the pricing of the loan, but are not captured in the data.

The rule applies to agent lenders, principal agents, and broker-dealers but will impact other market participants as well:

- Agent lenders will be measured against industry-wide data regarding their ability to monetize client inventory. This will increase pressure on lending fees.

- Principal agents maybe incentivized to employ a lending agent, given the cost of complying with the regulation.

- Broker-dealers will feel pressure from the buy-side on borrow rates compared to industry benchmarks.

- Borrowers will be able to see wholesale prices and the industry-wide retail spread.

- Marketplaces will report trading volume for the first time, allowing comparisons between bilateral/OTC and centralized marketplaces, potentially leading to winner-take-all dynamics.

- Data vendors that currently provide stock loan market data need to think of new ways to differentiate their products.

- Reporting agents will emerge as a new category that vendors and some marketplaces can cater to.

A technology-first prime broker

Rule 10c-1 doesn’t go into effect until 2025, but the industry must begin preparing for the sheer volume of data and reporting requirements. Clear Street processes its data in near-real-time, and is well-positioned to comply with the regulation.

Clear Street supports the intent to provide market transparency, better price discovery, and monitor systemic risk. Furthermore, we’re excited to get our hands on this data to see how we can leverage it to improve our processes and better serve our clients.

As an API-first prime broker, Clear Street is keen to provide easy access to valuable datasets to our customers, in Securities Finance and beyond.

Listen to the Word on the (Clear) Street podcast here, and read more about our securities finance technology Modern Technology for the Complex World of Securities Finance here.

This blog was originally published on TabbFORUM.

Get in touch with our team

Contact usClear Street does not provide investment, legal, regulatory, tax, or compliance advice. Consult professionals in these fields to address your specific circumstances. These materials are: (i) solely an overview of Clear Street’s products and services; (ii) provided for informational purposes only; and (iii) subject to change without notice or obligation to replace any information contained therein. Products and services are offered by Clear Street LLC as a Broker Dealer member FINRA and SIPC and a Futures Commission Merchant registered with the CFTC and member of NFA. Additional information about Clear Street is available on FINRA BrokerCheck, including its Customer Relationship Summary and NFA BASIC | NFA (futures.org). Copyright © 2024 Clear Street LLC. All rights reserved. Clear Street and the Shield Logo are Registered Trademarks of Clear Street LLC